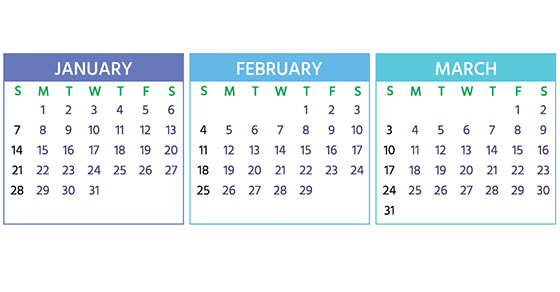

April 1, 2024

Employers – Electronically file 2023 Form 1097, Form 1098, Form 1099 (other than those with an earlier deadline) and Form W-2G

April 10, 2024

Individuals – Report March tip income of $20 or more to employers (Form 4070).

April 15, 2024

Individuals – File a 2023 income tax return (Form 1040 or Form 1040-SR) or file for an automatic six-month extension (Form 4868). (Taxpayers who live outside the United States and Puerto Rico or serve in the military outside these two locations are allowed an automatic two-month extension without requesting an extension.) Pay any tax due.

Individuals – Pay the first installment of 2024 estimated taxes (Form 1040-ES) if not paying income tax through withholding or not paying sufficient income tax through withholding.

Individuals – Make 2023 contributions to a traditional IRA or Roth IRA (even if a 2023 income tax return extension is filed).

Individuals – Make 2023 contributions to a SEP or certain other retirement plans (unless a 2023 income tax return extension is filed).

Individuals – File a 2023 gift tax return (Form 709) or file for an automatic six-month extension (Form 8892). Pay any gift tax due. File for an automatic six-month extension (Form 4868) to extend both Form 1040 and Form 709 if no gift tax is due.

Household employers – File Schedule H, if wages paid equal $2,600 or more in 2023 and Form 1040 isn’t required to be filed. For those filing Form 1040, Schedule H is to be submitted with the return so is extended if the return is extended.

Calendar-year trusts and estates – File a 2023 income tax return (Form 1041) or file for an automatic five-and-a-half-month extension (Form 7004) (six-month extension for bankruptcy estates). Pay any income tax due.

Calendar-year corporations – File a 2023 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004). Pay any tax due.

Calendar-year corporations – Pay the first installment of 2024 estimated income taxes, completing Form 1120-W for the corporation’s records.

Employers – Deposit Social Security, Medicare and withheld income taxes for March if the monthly deposit rule applies.

Employers – Deposit nonpayroll withheld income tax for March if the monthly deposit rule applies.

Employers – Report Social Security and Medicare taxes and income tax withholding for first quarter 2024 (Form 941) and pay any tax due if all of the associated taxes due weren’t deposited on time and in full.